For a reverse mortgage to be a practical monetary choice, existing home mortgage balances normally need to be low enough to be settled with the reverse mortgage profits. Nevertheless, borrowers do have the option of paying down their existing mortgage balance to get approved for a HECM reverse mortgage. The HECM reverse mortgage follows the standard FHA eligibility requirements for residential or commercial property type, implying most 14 family houses, FHA approved condominiums, and PUDs qualify.

Before starting the loan procedure for an FHA/HUD-approved reverse mortgage, applicants should take an approved counseling course. An approved counselor should assist discuss how reverse home mortgages work, the monetary and tax implications of getting a reverse home loan, payment options, and expenses related to a reverse home mortgage. The counseling is meant to secure debtors, although the quality of therapy has actually been criticized by groups such as the Consumer Financial Defense Bureau. what is the current interest rate on reverse mortgages.

On March 2, 2015, FHA implemented brand-new standards that need reverse is wesley financial group legitimate mortgage candidates to undergo a monetary evaluation. Though HECM borrowers are not required to make monthly mortgage payments, FHA wishes to ensure they have the monetary ability and desire to keep up with property taxes and property owner's insurance (and any other appropriate home charges).

Prior to 2015, a Lender could not refuse a demand for a HECM as the requirement is age 62+, own a home, and satisfy initial debt-to-equity requirements. With FA, the loan provider might now force Equity "set aside" guidelines and amounts that make the loan impossible; the like a declination letter for bad credit.

More About What Does Arm Mean In Mortgages

Satisfying credit - All housing and installment debt payments need to have been made on time in the last 12 months; there disappear than two 30-day late mortgage or installment payments in the previous 24 months, and there is no major bad credit on revolving accounts in the last 12 months.

If no extenuating scenarios can be recorded, the borrower may not qualify at all or the loan provider might require a big amount of the principal limitation (if readily available) to be taken into a Life Span Reserve (LESA) for the payment of residential or commercial property charges (real estate tax, property owners insurance coverage, and so on).

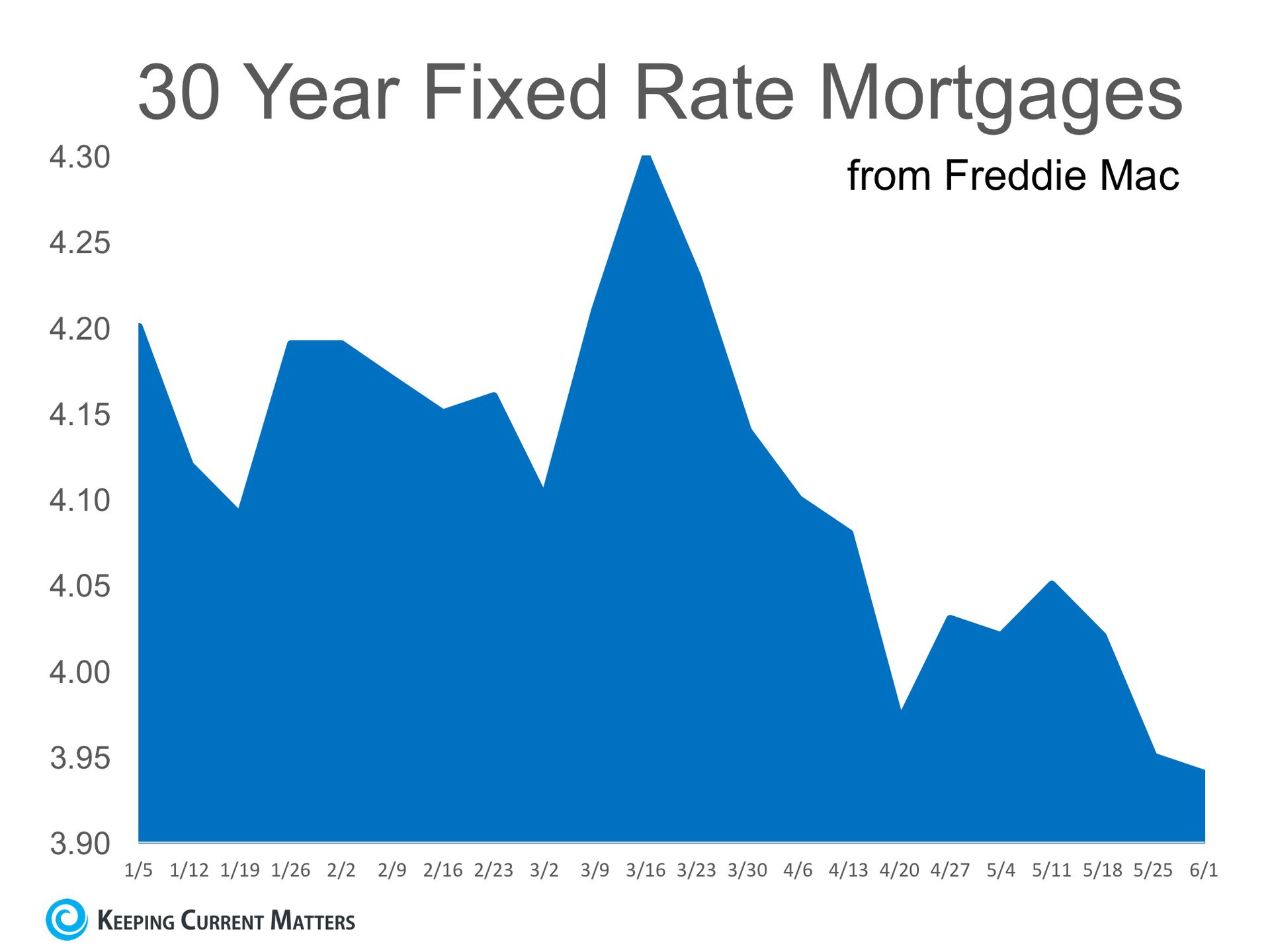

The fixed-rate program comes with the security of an interest rate that does not alter for the life of the reverse home loan, however the rate of interest is usually higher at the start of the loan than an equivalent adjustable-rate HECM. Adjustable-rate reverse mortgages generally have interest rates that can change on a monthly or annual basis within specific limitations.

The initial rates of interest, or IIR, is the real note rate at which interest accumulates on the impressive loan balance on an annual basis. For fixed-rate reverse home loans, the IIR can never change. For adjustable-rate reverse home loans, the IIR can alter with program limitations up to a lifetime rate of interest cap.

What Do Underwriters Do For Mortgages - Truths

The EIR is frequently various from the real note rate, or IIR. The EIR does not identify the quantity of interest that accumulates on the loan balance (the IIR does that). The overall swimming pool of cash that a customer can get from a HECM reverse home loan is called the principal limit (PL), which is calculated based on the optimum claim amount (MCA), the age of the youngest customer, the expected interest rate (EIR), and a table to PL aspects released by HUD.

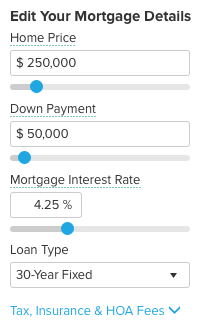

Many PLs are normally in the series of 50% to 60% of the MCA, but they can in some cases be greater or lower. The table below offers examples of primary limits for different ages and EIRs and a home value of $250,000. Customer's age at origination Anticipated rates of interest (EIR) Principal limitation aspect (since Aug.

To put it simply, older borrowers tend to get approved for more cash than younger customers, but the overall amount of cash offered under the HECM program tends to reduce for any ages as rate of interest rise. Closing expenses, existing mortgage balances, other liens, and any real estate tax or house owners insurance due are typically paid of the preliminary primary limit.

The money from a reverse mortgage can be dispersed in 4 ways, based on the debtor's financial requirements and objectives: Lump amount in cash at settlement Month-to-month payment (loan advance) for a set number of years (term) or life (period) Line of credit (comparable to a house equity credit line) Some combination of the above Note that the adjustable-rate HECM uses all of the above payment choices, however the fixed-rate HECM just uses lump amount.

The Buzz on Obtaining A Home Loan And How Mortgages Work

This indicates that customers who go with a HECM credit line can potentially gain access to more cash gradually than what they at first received at origination. The line of credit growth rate is figured out by adding 1.25% to the preliminary interest rate david tavarez (IIR), which indicates the line of credit will grow much faster if the rate of interest on the loan boosts.

Since lots of debtors were taking full draw swelling amounts (typically at the encouragement of loan providers) at closing and burning through the cash quickly, HUD sought to protect debtors and the practicality of the HECM program by restricting the amount of proceeds that can be accessed within the first 12 months of the loan.

Any remaining available proceeds can be accessed after 12 months. If the total necessary obligations go beyond 60% of the primary limitation, then the customer can draw an additional 10% of the principal limitation if readily available. The Housing and Economic Healing Act of 2008 provided HECM mortgagors with the opportunity to buy a new principal residence with HECM loan proceeds the so-called HECM for Purchase program, effective January 2009.

The program was developed to allow the elderly http://donovanmssy992.cavandoragh.org/unknown-facts-about-why-do-banks-sell-mortgages-to-other-banks to buy a new principal home and acquire a reverse home loan within a single transaction by getting rid of the need for a second closing. Texas was the last state to permit reverse mortgages for purchase. Reverse home loans are often criticized over the concern of closing expenses, which can in some cases be expensive.

Getting The How To Calculate How Much Extra Principal Payments On Mortgages To Work

Thinking about the constraints imposed upon HECM loans, they are similar to their "Forward" contemporaries in total costs. The following are the most typical closing costs paid at near obtain a reverse home loan: Therapy charge: The initial step to get a reverse home loan is to go through a counseling session with a HUD-approved therapist.

Origination charge: This is charged by the lender to organize the reverse home loan. Origination charges can differ commonly from loan provider to loan provider and can range from nothing to an optimum of $6,000. Third-party fees: These charges are for third-party services worked with to complete the reverse mortgage, such as appraisal, title insurance coverage, escrow, federal government recording, tax stamps (where suitable), credit reports, etc.

The IMIP safeguards lending institutions by making them whole if the home offers at the time of loan repayment for less than what is owed on the reverse home mortgage. This secures debtors as well since it means they will never ever owe more than their home is worth. As of 1/2019, the IMIP is now 2% of the max claim quantity (Either the assessed worth of the house up to a maximum of $726,535) The yearly MIP (home loan insurance premium) is.50% of the impressive loan balance.